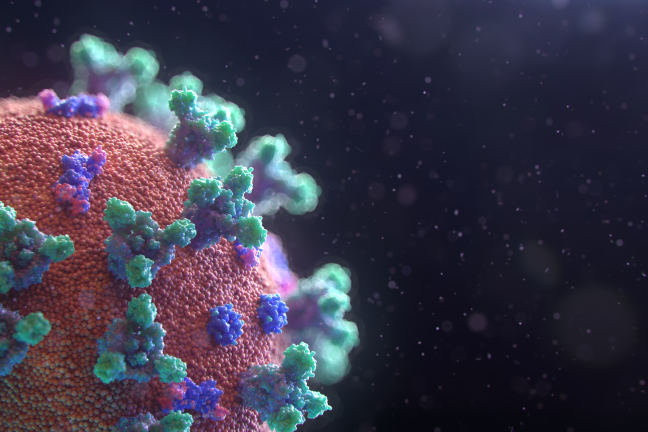

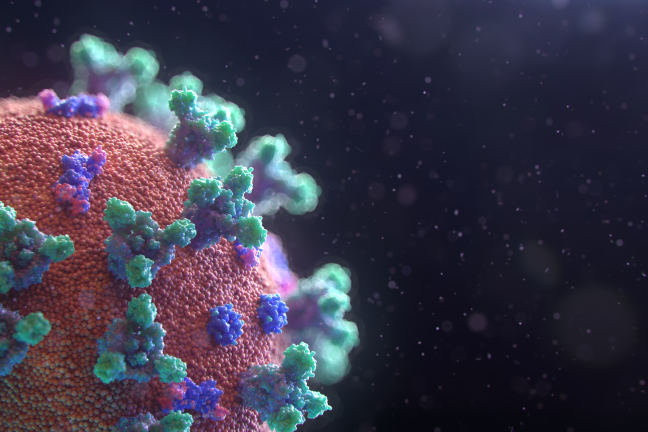

Coping with Coronavirus

This newsletter is a series of resources to help people deal with the changes created by coronavirus. It covers topics from working remotely to how to stay entertained.

Latest from the blog.

This newsletter is a series of resources to help people deal with the changes created by coronavirus. It covers topics from working remotely to how to stay entertained.

As the spread of coronavirus continues, it is no longer business as usual. This newsletter takes a look at the effects on our supply chains and the packaging industry.

Recently, large corporations have made huge commitments to make their organisations more sustainable. What does that mean for entrepreneurs?

This post takes a closer look at the status of female founders and angel investors, uncovering the stats on our platform. It also shines a light on some startups addressing the gender imbalance.

We take a closer look at the environmental and social impact that some of the startups on SeedTribe are having.

This newsletter looks at the SeedTribe startups shaping the cities of the future.

Are you making your own pitch deck? Read this blog for our top tips on how to make an engaging deck.

Our February newsletter looks at what startups are doing to address SDG 13: Climate Action.

A brief roundup of our features in the press talking about the role of business in addressing climate action.

A brief overview of some of our latest press features, including coverage of the relaunch of our Impact Hub.

Our first newsletter of 2020 outlines our exciting new plans for the year ahead.

SeedTribe's CEO, Liv Sibony, was recently invited to be part of a round table about how to make impact investing mainstream. Read the first in a series of blogs about our findings here.

Our end of year newsletter sums up our highlights for 2019.

Startup Wagestream tackles poverty premium in Britain by address the payday loan crisis.

This post provides a practical guide to help companies measure their social or environmental impact.

Securing investment requires organisation and planning to make the process as efficient and effective as possible. Using an investor pipeline spreadsheet can help you keep track of your interactions with investors.

This week we profiled Bippit and Smart Purse, which are two startups using technology to transform how people can access money, financial information and services.

Our key takeaways from Blooming Founders Next Level Growth Conference. It was a day of talks, panel discussions, and mentoring to help entrepreneurs take their startup to the next level.

This weeks newsletter on the fashion industry and sustainable consumption. We spotlighted Compare Ethics and Loopster, which are two innovative startups aiming to make the fashion industry more sustainable.

Our October newsletter was on the re-launch of our brand new hub. This month we shared with our readers some of our favourite startups, podcasts and webinars on the topics of waste and mental health.

Following on from World Mental Health Day, we are exploring mental health issues, looking at the new products and services startups have developed to improve mental wellbeing.

This blog post is all about the novel ways that startups are reusing waste and helping to address SDG 12: responsible consumption and production.

This blog post focuses on the different ways that business can report on their impact.

We discuss if banning plastic is really the best option and look at Teysha Technologies' alternative to traditional plastics.

Impact investing has recently been growing in popularity. In this post we discuss what is meant by the term.

In this post we explore what is meant by the term 'impact' and why it is important for businesses to measure their impact.

PwC's 2018 report on how businesses are adopting the UN's Sustainable Development Goals shows that there is still a lot that needs to be done.

The Social Value Exchange is a GovTech startup that channels resources into community projects across London.

Advanced Sustainable Development are an innovative waste transformation company. They are transforming the recycling industry with an aim to improve how plastics are recycled and to create a transparent and sustainable circular economy.

Our interview with Jessica Dick, Co-Founder of Five Years Time, about how her business and how to raise investment.

Grants are a fantastic resource for financing startups. Our interviews with the Founders of Mimica Labs and SafteyNet provide insight into what grants are available and how to apply for them.

We value quality over quantity when it comes to the businesses we support. To ensure we only present high-quality, viable businesses we have a rigorous and competitive selection process. Read on to find out the top 10 reasons we reject businesses.

The final of our Impact Investing Interview series is with Chris Sheldrick, the CEO and Co-founder of what3words. what3words is the simplest way to talk about location. It has divided the world into 3m x 3m squares, each with a unique 3 word address.

In the next in our Impact Investing Interview series, we spoke to Dean Fisher, the Director of Bow Street Media whose latest project ‘Film Ahoy‘ is bringing a socially-conscious angle to online film distribution.

In the first of our Impact Investing Series, we interviewed Danny Witter, CEO and Co-Founder of Work For Good, to find out more about the business.

Let stories from our community inspire you…

A journey of a thousand miles begins with a single step →

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. SeedTribe is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via SeedTribe once you are registered as sufficiently sophisticated. Please click here to read the full Risk Warning.

This page is approved as a financial promotion by SeedTribe Limited, which is authorised and regulated by the Financial Conduct Authority. Pitches for investment are not offers to the public and investments can only be made by members of seedtribe.com on the basis of information provided in the pitches by the companies concerned. SeedTribe takes no responsibility for this information or for any recommendations or opinions made by the companies.

The availability of any tax relief, including EIS and SEIS, depends on the individual circumstances of each investor and of the company concerned, and may be subject to change in the future. If you are in any doubt about the availability of any tax reliefs, or the tax treatment of your investment, you should obtain independent tax advice before proceeding with your investment.